How Can Families Plan Financially for Senior Care During the Holidays?

For many families, the holidays are the first time everyone is in the same room long enough to talk about what really matters. That often includes money, health, and how to support an aging parent moving forward. Financial planning for senior care usually begins by looking honestly at current expenses, understanding what kind of help may be needed in the coming months or years, and talking openly about what’s realistic for the family.

How Can Families Plan Financially for Senior Care During the Holidays?

For many families, the holidays are the first time everyone is in the same room long enough to talk about what really matters. That often includes money, health, and how to support an aging parent moving forward. Financial planning for senior care usually begins by looking honestly at current expenses, understanding what kind of help may be needed in the coming months or years, and talking openly about what’s realistic for the family.

The holidays should bring joy, not financial stress. For families caring for senior loved ones, this season often means balancing celebration with caregiving costs, managing fixed incomes, and ensuring comfort without overspending.

Financial planning during the holidays isn’t just about budgets and spreadsheets. It’s about creating meaningful moments while protecting your loved one’s long-term security. Whether your family member receives home care services or you’re considering support for the first time, thoughtful planning ensures everyone can celebrate fully without worry.

This guide offers practical strategies for holiday budgeting on a fixed income, managing care costs during busy months, and finding joy in affordable celebrations. You’ll discover how to stretch every dollar, access helpful resources, and plan ahead for a peaceful new year.

Why Financial Planning Matters During the Holidays

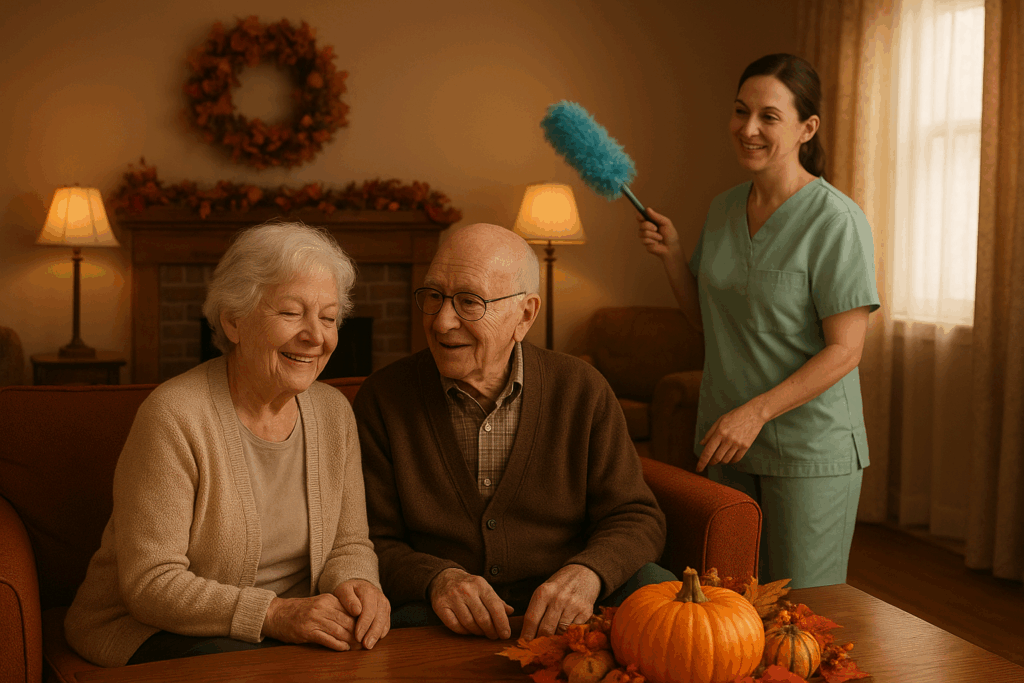

Ensuring Safe, Joyful Celebrations at Home

Your loved one deserves to feel comfortable and secure during holiday gatherings. Professional caregivers can help with tasks that become more challenging during busy seasons: assistance with dressing in festive attire, support getting in and out of vehicles safely for family visits, and ensuring proper medication management when routines shift.

Planning for these needs early prevents last-minute scrambling and allows your family to focus on what matters most.

Supporting Care Needs Without Added Stress

Holiday excitement can disrupt regular care routines. Meal times change, sleep schedules shift, and emotional energy runs high. Having a financial plan for additional support during peak celebration days means your loved one receives consistent care while the family enjoys festivities together.

Avoiding Costly Holiday Surprises and Unplanned Expenses

Unexpected costs add up quickly during the holidays. Emergency care needs, last-minute gift purchases, or unplanned travel expenses can strain already tight budgets. Setting aside a small emergency fund specifically for December helps cushion these surprises without derailing your entire financial plan.

Smart Holiday Budgeting for Seniors

Start with Core Needs: Comfort, Safety & In-Home Support

Before allocating funds for gifts and decorations, ensure essential care expenses are covered. This includes:

- Regular home care services

- Prescription medications

- Medical equipment or supplies

- Nutritious meals and hydration needs

- Safe, warm home environment

Once these foundations are secure, you can confidently budget for celebration extras.

Prioritize Quality Time over Costly Gifts

The most meaningful gifts cost nothing. Consider these budget-friendly alternatives to expensive presents:

- Memory-making experiences: Watch favorite holiday movies together, bake simple recipes, or look through old photo albums

- Handmade gifts: Create personalized cards, knit warm accessories, or compile family recipe books

- Service gifts: Offer specific help like weekly grocery shopping, home organization, or tech support

Your presence and attention mean more than any store-bought item.

Bring the Family Together in Budget Conversations

Open communication prevents misunderstandings and ensures everyone contributes appropriately. Schedule a family meeting before the holidays to discuss:

- Current care costs and who covers what

- Holiday spending limits that everyone can honor

- Gift-giving approaches (drawing names, group gifts, etc.)

- Shared responsibilities for meals and gatherings

When everyone understands the financial picture, decisions become easier and guilt decreases.

Stretching Your Budget on a Fixed Income

Tracking Spending & Setting Kind Spending Limits

| Expense Category | Budget Range | Money-Saving Tips |

| Gifts for family | $50-$150 | Draw names, set $20-30 per person limit, make homemade items |

| Holiday meals | $75-$200 | Potluck style, simple menus, use seasonal produce |

| Decorations | $0-$50 | Reuse previous years, make DIY crafts, borrow from family |

| Cards & postage | $20-$40 | Digital cards, phone calls instead, buy stamps in bulk |

| Special activities | $0-$100 | Free community events, at-home celebrations, and volunteer together |

Leveraging Senior Discounts & Local Resources

Many organizations offer special support during the holidays:

- Community centers: Free or low-cost holiday meals, entertainment programs, and social gatherings

- Senior centers: The NYC Department for the Aging provides extensive resources including nutritious meals and social events

- Libraries: Host free holiday programs, craft workshops, and entertainment throughout winter months

- Places of worship: Often provide meal assistance, gift programs, and companionship opportunities

- Retail discounts: Many stores offer additional senior discounts during holiday shopping periods

Don’t hesitate to ask about available programs. These resources exist to support you.

Affordable Holiday Activities That Bring Joy

Creating warm memories doesn’t require expensive outings:

- Attend free community concerts or light displays

- Participate in virtual holiday events from home

- Enjoy hearty, hot meals like soups and stews together

- Sip warm beverages such as herbal tea while sharing stories

- Watch holiday specials on television

- Create simple crafts or decorations together

- Listen to favorite holiday music

- Video call with distant family members

These simple moments often become the most treasured memories.

How to Budget for Home Care Services During the Holidays

Understanding Service Costs & What’s Included

Home care services typically include:

- Personal care assistance with bathing, grooming, and dressing

- Meal preparation focusing on warming, nutritious foods

- Light housekeeping to maintain comfortable living spaces

- Medication management for proper timing and dosing

- Transportation to appointments when family isn’t available

- Companionship and emotional support

Knowing exactly what’s covered helps you plan accurately and avoid surprise charges. You can always contact us for more information on the services and the tailored plans created especially for your loved one.

Using Insurance, Veterans Benefits & Assistance Programs

| Funding Source | What It Covers | How to Access |

| Medicare | Limited home health after hospitalization | Contact provider after discharge |

| Medicaid | Long-term home care services | Apply through state Medicaid office |

| Veterans Benefits | Aid and Attendance for eligible veterans | Visit VA.gov or local VA office |

| Long-term care insurance | In-home care services per policy | Review policy, contact insurer |

| State assistance programs | Varies by location and need | Contact Area Agency on Aging |

Flexible Scheduling: Seasonal or Short-Term Home Care

You don’t need to commit to full-time care year-round. Many families increase support during busy holiday weeks, then scale back afterward. This flexibility allows you to:

- Add extra hours during major celebrations

- Schedule coverage for specific events

- Adjust as family availability changes

- Maintain consistent care without overextending budgets

Planning for Respite Care When Family Caregivers Travel

If primary family caregivers travel during the holidays, respite care ensures your loved one receives uninterrupted support. This service prevents caregiver burnout and allows the entire family to sustain their support long-term. Book respite care early, as December fills quickly.

Reducing Holiday Financial Stress

Talk Openly About Care Needs and Family Responsibilities

Honest conversations prevent resentment and confusion. Address these topics directly:

- Current and anticipated care needs

- Who provides hands-on help versus financial support

- Backup plans when primary caregivers need breaks

- Long-term care planning beyond the holidays

These discussions feel uncomfortable initially, but create lasting clarity and cooperation.

Prevent Overspending Driven by Emotions

The strong emotions that come with the holidays can sometimes trigger guilt-driven purchases. To combat this, we recommend creating a clear budget before you start shopping and giving yourself at least 24 hours before making any large purchases. It’s important to remember that your loved one values your presence far more than presents. Focusing on meaningful gestures and quality time together, rather than expensive items, will make the season truly special for everyone.

Maintain Boundaries While Still Celebrating Fully

Setting limits isn’t selfish; it’s sustainable. You can say:

- “We’re keeping gifts simple this year to focus on being together”

- “I can contribute $X toward the family gathering”

- “I’m available for visits on these specific days”

- “We’re celebrating at home this year instead of traveling”

Boundaries protect your financial health and prevent burnout.

Looking Ahead to a Peaceful, Supportive New Year

Review Holiday Costs & Care Needs

After the holidays, take time to evaluate what worked and what didn’t. Consider:

- Which expenses brought the most joy?

- Where could you have saved money?

- Did care arrangements meet everyone’s needs?

- What would you change next year?

This reflection informs better planning for future celebrations.

Set Gentle Financial Goals for 2026

Rather than rigid resolutions, create kind goals:

- Build a small emergency fund ($500-$1,000)

- Research additional assistance programs

- Schedule regular family financial check-ins

- Explore long-term care insurance options

Small, steady progress matters more than perfection.

Plan Long-Term Home Care Support Early

At All Heart Homecare, we believe that true peace of mind comes from being prepared. That’s why we gently encourage you not to wait for a moment of crisis to arrange care. By planning ahead, you give yourself the precious time needed to thoughtfully research and select quality providers, truly understand all the financial aspects involved, and, most importantly, introduce caregivers gradually, fostering comfort and familiarity. This foresight significantly eases the burden and stress during unexpected medical emergencies, ensuring a far smoother and more reassuring experience for everyone involved.

For over 13 dedicated years, All Heart Homecare has been a steadfast source of compassionate support for families across the Bronx, Brooklyn, Manhattan, Queens, and Staten Island. Our devoted, multilingual caregivers are not just skilled professionals; they deeply understand and honor the unique needs and rich cultural tapestry of our diverse communities, ensuring every individual receives care that is truly from the heart.

When to Seek Guidance from a Care Coordinator or Financial Expert

Consider professional help if you’re experiencing:

- Overwhelming caregiver responsibilities

- Confusion about available benefits

- Family disagreements about care or finances

- Difficulty managing multiple medications or appointments

- Uncertainty about long-term planning

Support groups and helplines can provide emotional support and practical advice. You don’t have to navigate this journey alone.

Create Joyful Holidays Without Financial Worry

Financial planning for senior care during the holidays protects both your loved one’s well-being and your family’s peace of mind. By prioritizing essential needs, leveraging available resources, and maintaining open communication, you can create meaningful celebrations without overspending.

Remember that the best holiday gifts aren’t found in stores. Your time, attention, and consistent care provide more comfort than any expensive present. When you plan thoughtfully and set kind boundaries, everyone benefits.If you’re considering home care support for your loved one, our compassionate team is here to help. We understand the balance between quality care and budget constraints. Contact All Heart Homecare to discuss flexible care options that work for your family’s unique situation. Together, we’ll ensure your loved one enjoys a safe, joyful holiday season.