- What Services Are Covered by Medicaid?

- Who Is Eligible for New York Medicaid?

- What Is the “Look Back Period”?

- Financial Requirements for Medicaid

- How to Apply for Medicaid in New York State?

- What Is the Difference Between Medicaid and Medicare?

- Can I have both Medicare and Medicaid?

- In Conclusion

Medicaid stands as a vital pillar in the U.S. healthcare system, providing essential health coverage for low-income individuals, families, and children.

New York’s Medicaid program is designed to offer comprehensive health coverage to over 7.3 million residents with limited financial means. The program covers a diverse range of health services tailored to individuals based on factors such as age, financial circumstances, family situation, or living arrangements.

Medicaid beneficiaries can access a broad spectrum of services through a vast network of healthcare providers. These services are easily accessible by presenting the Medicaid card directly or through a managed care plan for those enrolled in managed care.

What Services Are Covered by Medicaid?

In New York State, Medicaid offers an extensive range of medical services that can be organized into three distinct categories:

1. Community Services

- Services provided by physicians, dentists, nurses, optometrists, and other related professional personnel,

- Outpatient or clinic services,

- Provision of sickroom supplies, eyeglasses, and prosthetic appliances,

- Physical therapy services,

- Laboratory and X-ray services,

- Transportation when essential to obtain medical care,

- Prescription drugs.

- Home health services, including nursing, physical therapy, occupational therapy, and home health aide,

- Personal care (home attendant) services,

- Long-term home healthcare program, also known as the “Lombardi” or “nursing home without walls.”

3. Institutional Services

- Care provided in hospitals, nursing homes, and other medical facilities.

This comprehensive coverage reflects the commitment of Medicaid in New York State to address the diverse healthcare needs of eligible individuals.

Also, Medicaid extends its support to crucial programs such as the Nursing Home Transition and Diversion (NHTD) Waiver and Traumatic Brain Injury (TBI) Waiver. The NHTD Waiver empowers individuals with disabilities to transition from nursing homes to community-based settings, fostering independence and enhanced quality of life.

The TBI program offers tailored services like rehabilitation therapies, community integration, and support for daily living activities, promoting recovery and optimal functioning.

Who Is Eligible for New York Medicaid?

You’re eligible for Medicaid if you meet the following criteria:

- You are a U.S. national, citizen, permanent resident, or legal alien

- You reside in New York State

- You (or eligible members of your family) need help with medical care/insurance coverage

- Your financial situation falls within the low-income category (more details below).

In addition to these requirements, you must also be one of the following:

- Pregnant

- Disabled

- Have a member of your family/household with a disability

- Be responsible for a child 18 years of age or younger

- Diagnosed with blindness

- 65 years of age or older

Financial Eligibility:

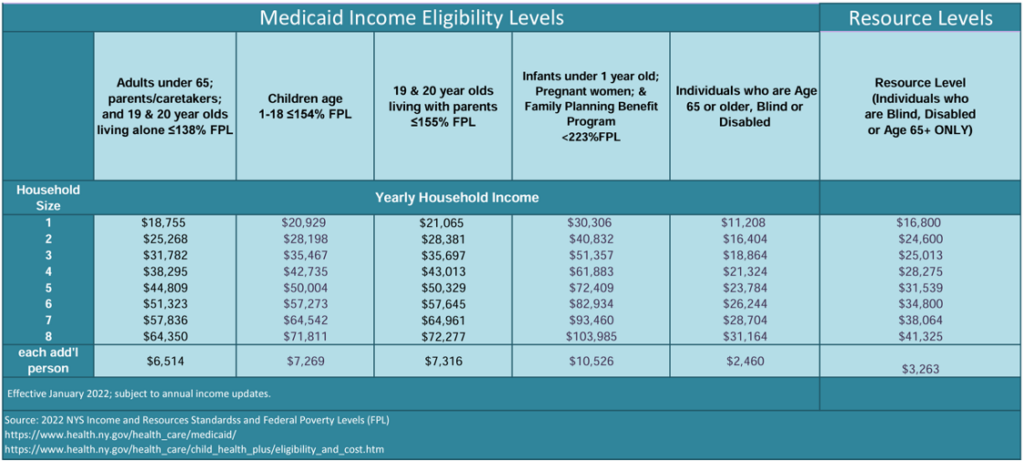

Medicaid is a means-tested program, implying that applicants must meet certain income eligibility requirements tied to household size.

Source: nyc.gov

What Is the “Look Back Period”?

New York employs a 60-month “look back” period for Medicaid applicants seeking nursing home care. This involves a comprehensive review of the applicant’s financial transactions over the five years preceding the application date. The aim is to identify any assets that were sold or given away for less than fair market value. The “look back” period serves as a deterrent against individuals transferring their possessions to qualify for Medicaid. Any transfers violating the fair market value rule can result in a penalty period of Medicaid ineligibility.

Exceptions to the Look-Back Period

The COVID-19 pandemic has had a profound impact on Medicaid eligibility, leading to temporary adjustments. As of the latest update in April 2022, the COVID Public Health Emergency extension prevents Medicaid discontinuation or increases in the “spend-down” until August 1, 2022. This extension affects the 30-month look-back period, delaying its application until October 1, 2022 (as of 9/27/2022). Those planning to apply for Home Care Medicaid before this date may avoid the standard look back and penalties for transfers, emphasizing the urgency for potential beneficiaries to consult Medicaid planning teams promptly.

Financial Requirements for Medicaid

Medicaid imposes both asset and income limits on applicants. Income encompasses funds from various sources, while assets include any potentially valuable property under the applicant’s control. In 2022, the monthly income limit for an individual was $934, with a corresponding limit of $1,367 for a married couple applying for Medicaid. Asset limits were $16,800 for a single Medicaid recipient and $24,600 for a couple. The government assesses whether individuals could cover care costs out of pocket, even if it involves selling most of their possessions.

Counted Assets Under Medicaid

Medicaid considers various assets during eligibility assessments, including funds from all sources, such as pensions, rent from income properties, interest or dividends from investments, wages, and Social Security Income. Medicaid may also count retirement accounts, annuities, and real estate as assets.

Assets Not Counted Under the Means Test

Certain assets are exempt from the means test under specific conditions. These include the primary residence (if occupied by the applicant, spouse, or a minor or disabled child), one automobile, burial allowance (up to $1,500), Irrevocable Burial Trust (any pre-paid burial space such as a casket, grave, headstone, crypt, or mausoleum), and personal property (with considerations for high-value items). Additionally, the first $20 of income each month is not counted by Medicaid.

Navigating Medicaid financial eligibility in New York requires a nuanced understanding of the “look back” period, exceptions, and specific financial requirements. Potential beneficiaries are encouraged to seek timely advice from Medicaid planning teams to optimize their chances of qualifying for assistance. As rules and regulations may change, staying informed about the latest updates is crucial for individuals seeking Medicaid benefits in the state of New York.

How to Apply for Medicaid in New York State?

Navigating the Medicaid application process in New York requires careful attention to eligibility criteria and documentation. By following these steps, individuals can increase their chances of a successful application and gain access to the healthcare coverage they need.

Step 1: Determine Your Eligibility Criteria

The first step in applying for Medicaid is understanding your eligibility criteria. The process varies depending on whether you fall under Modified Adjusted Gross Income (MAGI) eligibility groups or non-MAGI eligibility groups.

MAGI Eligibility Groups:

- Children between 1 to 18 years of age

- Infants under the age of 1

- Adults aged 19 to 64 years who are not eligible for Medicaid

- Pregnant women

- Caretaker relatives and parents with Medicare

Individuals falling under MAGI eligibility groups should apply through the NY State of Health.

Non-MAGI Eligibility Groups:

- Individuals older than 65 without caretakers

- Blind or disabled individuals not in MAGI eligibility groups, including those needing Consumer Directed Personal Assistance Services (CDPAS) or Personal Care Services (PCS)

- Individuals eligible for various programs such as COBRA, AIDS Health Insurance Program (AHIP), Medicare Savings Program (MSP), Medicaid Buy-In Program for Working People with Disabilities, etc.

Those in non-MAGI eligibility groups should apply through their Local Department of Social Services (LDSS).

Eligibility is determined by factors such as income, family/household size, state residency, and immigration/citizenship status.

Step 2: Gather Necessary Information

Incomplete information can lead to application rejection, so it’s crucial to gather all necessary documents before submitting your Medicaid application. Required documents include:

- Birth certificate

- Proof of citizenship

- Proof of income (Social Security, Veteran’s benefits, Supplemental Security Income, paystubs, tax return, or other income sources)

- Proof of assets, bank statements, and financial resources mentioned in the application

- Proof of residence (rent receipts, recent mail to current address, mortgage form)

- Proof of other insurance (copy of Medicare card)

Step 3: Submit the Application

New York State allows submissions through various methods, including online applications, paper applications, or dropping off applications at local Medicaid offices.

Apply By Phone – Call the Medicaid Helpline (800) 541-2831

Apply Online – Submit Medicaid application via the NYS Department of Health Marketplace website

Apply By Mail – Download the Medicaid application via the Health Marketplace website and mail it in

Apply In-Person – Visit your local Social Services office and follow their instructions on how to apply in-person

Facilitated Enroller (FE) – A Facilitated Enroller can assist you with the application process. Obtain a list of FEs here.

New York City Residents – If you live in New York City, you can apply here.

Regular Medicaid applications typically receive a response within 45 days, while disability applications may take up to 90 days.

What Is the Difference Between Medicaid and Medicare?

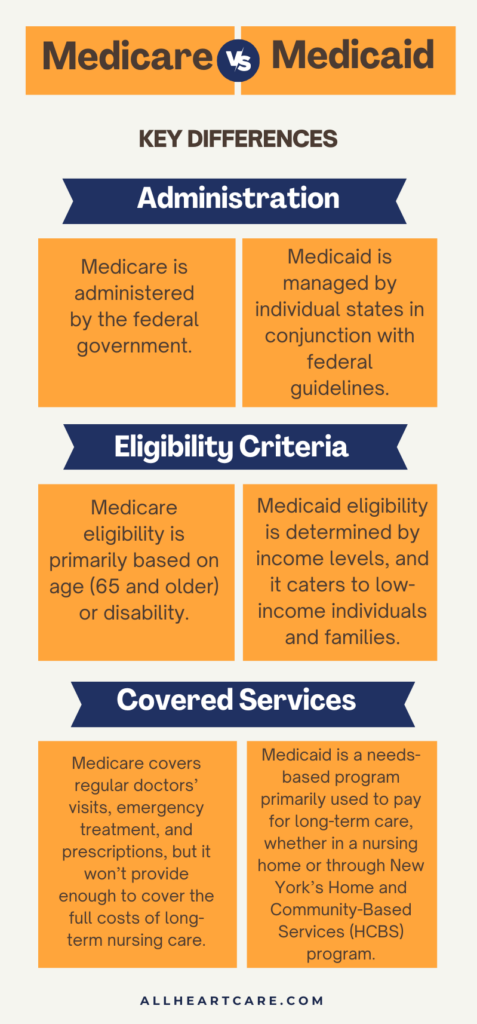

While both Medicare and Medicaid play crucial roles in the American healthcare landscape, their differences in administration, target populations, and eligibility criteria underscore the diverse needs they address.

Medicare Overview

Medicare stands as a federal health insurance program designed to cater primarily to the needs of older Americans. Funded through payroll taxes, Medicare is a critical safety net that ensures access to a broad spectrum of health services as individuals age. Enrollees in the Medicare program contribute to the coverage through monthly premiums, co-pays, and deductibles.

The Four Types of Medicare:

The Medicare program is multifaceted, encompassing four distinct categories known as parts. These are:

- Medicare Part A (Hospital Insurance): Covers inpatient care, including hospital stays, skilled nursing facility care, hospice care, and some home health care.

- Medicare Part B (Medical Insurance): Encompasses outpatient care, preventive services, and durable medical equipment. It ensures coverage for services from doctors and other health care providers.

- Medicare Advantage Part C: Offers an alternative to Original Medicare by providing coverage through private insurance plans. These plans often include additional benefits beyond what Original Medicare covers.

- Medicare Part D (Prescription Drug Coverage): Private insurance plans approved by Medicare provide prescription drug coverage, helping beneficiaries afford necessary medications.

Medicaid Overview

Medicaid, as we discussed above, is a public health insurance program designed to provide coverage for individuals with limited income and resources, irrespective of age. This program is a collaboration between the federal government and individual states. Medicaid enrollees typically experience minimal or no out-of-pocket costs for covered healthcare expenses, making it an essential lifeline for vulnerable populations.

Can I have both Medicare and Medicaid?

Yes, it is possible to have both Medicare and Medicaid in New York State. This is known as “dual eligibility.” To qualify for dual eligibility, you must meet the requirements for both Medicare and Medicaid and be enrolled in both programs.

If you have dual eligibility, your Medicaid and Medicare plans will collaborate to ensure comprehensive coverage for your healthcare needs. Generally, Medicare serves as the primary plan, covering most Medicare-eligible healthcare services, while Medicaid functions as the secondary plan, potentially covering medical expenses not fully covered or not covered by Medicare.

In Conclusion

Medicaid in New York serves as a crucial lifeline for over 7.3 million residents with limited financial means, offering comprehensive coverage across a diverse range of health services. Eligibility is based on factors such as income, residency, and specific circumstances, with a means-tested approach to assess financial qualifications. The “look back” period, exceptions, and financial requirements add complexity to the application process, emphasizing the need for timely advice from Medicaid planning teams.

At All Heart Homecare, we understand the importance of Medicaid program that provides essential health coverage for low-income individuals. If you or your loved ones are seeking further guidance or information on how to apply for the program, we’re here to help! Contact us today at 718-717-1164.